are federal campaign contributions tax deductible

AO 1993-12 Native American tribe as federal contractor. The Commission maintains a database of individuals who have made contributions to federally registered political committees.

Explore Our Sample Of Charitable Contribution Receipt Templat Charitable Contributions Charitable Receipt Template

All types of contribution besides money like time service and tangible goods.

. Is It Tax Deductible. According to the IRS the answer is a very clear NO. Contributions to civic leagues or other section 501c4 organizations generally are not deductible as charitable contributions for federal income tax purposes.

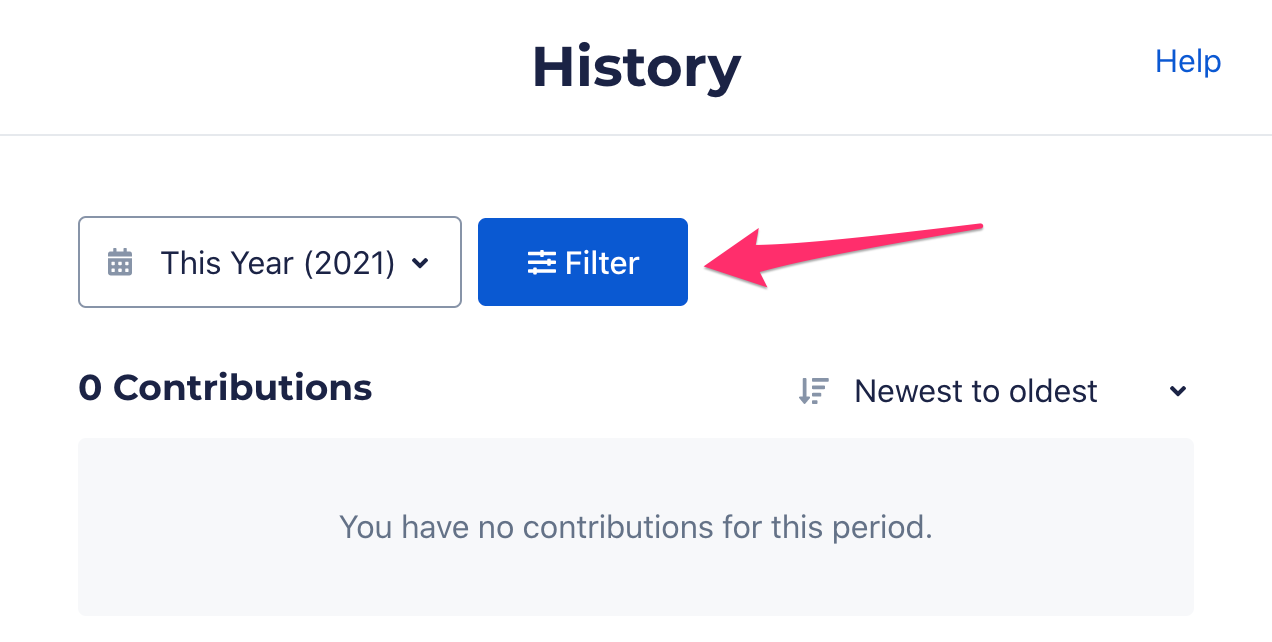

Resources for charities churches and educational organizations. How to get to the area to. When youre a federal government employee the Combined Federal Campaign CFC is a one-stop shop for making regular donations to your favorite charities.

Data on individual contributors. The CFC is comprised of 30 zones. Contributions must actually be paid in cash or other property before the close of an individuals tax year to be deductible for that tax year.

The IRS which has clear rules about what is and is not tax-deductible notes that any contributions donations or payments to. You cannot deduct contributions made to a political candidate a campaign committee or a newsletter fund. Your tax deductible donations support thousands of worthy causes.

Section 6113 of the Internal Revenue Code requires political committees whose gross annual receipts normally exceed 100000 to include a special notice on their. The IRS makes it clear that you cannot deduct contributions that you make to any organizations that arent qualified to receive tax-deductible donations. And some states offer tax breaks for campaign contributions.

Political contributions arent tax deductible. Thank you for contributing through the Combined Federal Campaign CFC. The following materials discuss the federal tax rules that apply to political campaign intervention by tax-exempt organizations.

Municipal Affairs acknowledges that unlike provincial and federal campaign donations municipal and school board campaign contributions are not tax deductible. Are Political Contributions Tax-Deductible. The funds do not affect your taxes or your deductions.

Generally only a small minority of total contributions come from those who. Yes you can deduct them as a Charitable Donation if you file Schedule A. Claim on line 40900 of the return your total federal political contributions for 2021.

Political contributions deductible status is a myth. When people do give most political donations are large given by a few relatively wealthy people. Through Combined Federal Campaign.

It doesnt matter if it is an individual business or other organization making the donation the campaign contribution is not deductible. This doesnt just mean. The IRS makes it clear.

Contributions must actually be paid in cash or other property before the close of an individuals tax year to be deductible for that tax year whether the individual uses the cash or. Claim on line 41000 of the return the credit you are entitled to. Can I deduct my contributions to the Combined Federal Campaign CFC.

Political donations arent deductible on federal income taxes but lots of other expenses are. Donors who are eligible to itemize charitable. Federal law does not allow for charitable donations through payroll deduction CFC or any other payroll deduction program to be done pre-tax.

The Natural State grants tax credits for statenot federalcampaign contributions of up to 50 for an individual 100 for a couple and it can be spread over. Completing your tax return.

Write Offs For The Self Employed For All The Visual Learners Out There This Board Is For You We Ve C Rowing Workout Rowing Machine Workout Machine Workout

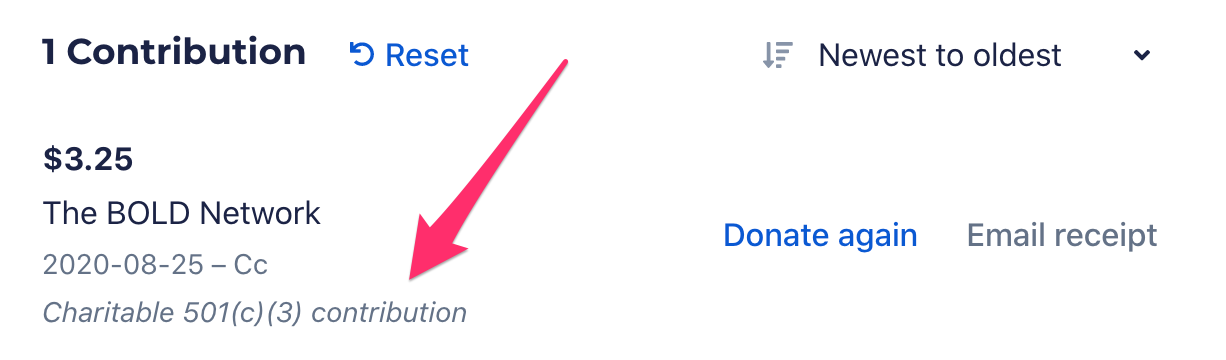

Are My Donations Tax Deductible Actblue Support

Are Political Contributions Tax Deductible Smartasset

Pin By The Project Artist On Understanding Entrepreneurship In 2022 Business Expense Understanding In A Nutshell

Are Political Contributions Tax Deductible Smartasset

Tmd Treatments Tmj Hope Gifts Grinding Teeth

Pin On Politics Current Affairs

Are Political Contributions Tax Deductible Smartasset

Are Political Contributions Tax Deductible H R Block

Are Political Contributions Tax Deductible Personal Capital

Are My Donations Tax Deductible Actblue Support

Why To Avoid 100 Of Agi Qualified Charitable Contributions Deduction Charitable Order Of Operations

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Are Campaign Contributions Tax Deductible

Federal And California Political Donation Limitations Seiler Llp

Are Political Contributions Tax Deductible Anedot

Are Political Donations Tax Deductible Credit Karma Tax

Are Political Contributions Tax Deductible H R Block

Are Political Contributions Tax Deductible Turbotax Tax Tips Videos